From individuals and expats to worldwide entrepreneurs, anyone can open a private or firm checking account in UAE without residency and achieve access to flexible monetary options. Our skilled group makes it easy to open a UAE checking account for foreigners or residents — making certain easy setup, quick approvals, and full compliance with banking laws. Dubai is amongst the leading investor’s pleasant business hub in the world . In all enterprise, problem free financial transactions are playing a vital function in business development. Bank account in Dubai presents the investors and firms very customer pleasant and problem free providers once the applicant meets apt necessities by the banks . Firm bank account in Dubai process Opening Personal Bank Account in Dubai Full Support is a straightforward task if you realize the proper documentation and KYC requirements of the banks .

Banks in the UAE provide all kinds of financial institution accounts, so it’s important to analysis their specifications and select https://execdubai.com/ the one that most carefully fits your needs. Not all banks will have the identical financial merchandise, so be thorough in your analysis. Opening a UAE bank account is an important step for companies and people looking to totally make the most of the advantages of working in this dynamic area. At INCORPORTAS, we combine our in-depth experience and a network of trusted banking companions to make sure a clean and environment friendly account opening course of.

The Difference In Between Resident And Non-resident Particular Person Offshore Accounts

One can manage their finances while visiting their UAE bank’s workplaces in individual or on-line. The course of can take wherever from 1-2 weeks to a month, relying on the complexity of the business and the bank’s inside procedures. Essential articles entrepreneurs ought to learn and have clarity earlier than deciding the corporate construction, business activity and business setup places. We can help you navigate the complex regulatory landscape and provide insights into the local business surroundings.

Uae Excise Tax Deduction Guide: What Fta Determination No 11 Of 2025 Modifications For 2026

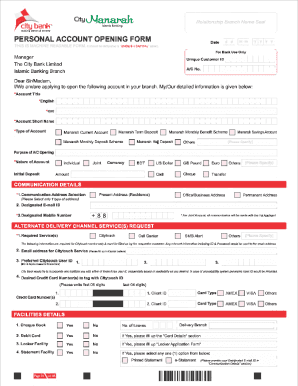

Non-residents can now open a bank account in Dubai without holding a UAE residency visa. With the proper documents—such as a passport copy, proof of tackle, and a purpose for account opening—you can begin the process remotely. Many banks now supply digital onboarding, making it easier than ever to get a non-resident bank account in UAE. The paperwork required to open a savings checking account in Dubai UAE might embody a passport copy, residence visa, Emirates ID, and proof of handle corresponding to a utility bill or rental agreement.

Whether you’re looking to open a resident or non-resident bank account in Dubai, the method is environment friendly, safe, and tailored to your needs. With advantages like multi-currency accounts, remote banking, and world-class buyer help, Dubai banking for non-residents and residents alike provides unmatched comfort and credibility. On-line checking account opening in UAE is easy when in comparison with the traditional banks however providers supplied by on-line banks are limited. Choosing the best financial institution and offering the required paperwork is important. Reach out to a enterprise setup consultant to make your means of opening a bank account in the UAE seamless.

- I had a fantastic expertise registering my company in the UAE with Gryffin Capitalist.

- Failure to satisfy this requirement may outcome in the account being subject to additional fees or, in some circumstances, closure by the bank.

- Whether Or Not you’re an expat, entrepreneur, or tourist— our specialists assist you to open a private orbusiness checking account within the UAE with ease.

- In the UAE offshore bank account encompasses a variety of companies.

- Nevertheless, the bank may require additional documentation to validate the character and function of the transaction.

The banks could ask for added data, corresponding to monetary statements, enterprise plans, or proof of income. Totally Different banks may have further necessities, so it’s a good idea to confirm with your chosen bank beforehand. Evaluating account options online can even help you find the best fit for your needs. After getting the corporate incorporation paperwork you’re ready to use for your offshore checking account. While most banks could have a cellular banking perform to help you switch cash and verify your steadiness, they could not permit you to apply for new accounts via their cell banking app.

You might be nervous that you just won’t have the power to get all the companies you want as a outcome of you’re a foreigner. In a day or two, an area delivery crew will contact you to let you understand when they’ll ship your new debit card. Banks within the United Arab Emirates usually permit you to open two forms of current accounts.

These limitations make it harder to access full banking options until you turn out to be a UAE resident. As Quickly As your software is permitted, the bank will provide your account quantity. The timeline varies relying on the bank and the complexity of your corporation. Working with specialists might help reduce delays by guaranteeing all paperwork are complete and correct. Contact Aljazat right now to discuss your banking needs and get began on your journey to financial freedom in the UAE. There are two major eventualities when utilizing company as a substitute of private/individual account.

Analysis And Select The Proper Bank

For extra particulars on checking account opening course of in Dubai, Seek The Guidance Of with our banking account opening advisers. Designed for day by day transactions, together with wage deposits, invoice funds, and debit card usage. If you’re planning to use your checking account to do enterprise within the UAE, you’ll have to open a company checking account setup a company in uae. The purpose why you have to open a company account is that UAE law prohibits you from doing enterprise with a private account. If you’re a non-resident, you’ll solely be in a position to open a savings account.

Why Rent Oxford Auditing For Opening A Financial Institution Account?

A Non-resident financial savings account can take somewhat longer to open due to the additional documentation. You can initiate the method on-line or with a relationship supervisor, but most banks require you to visit a branch in the UAE at least as soon as for final KYC verification. A valid entry permit or visa is needed, and many passport holders can keep within the UAE visa-free for up to 90 days. This guide explains how non-residents can open a personal account within the UAE, what documents are required, the step-by-step process, the benefits, and the common limitations. The time frame varies depending on the bank and the type of account. Our staff works to expedite the method by making certain all documentation is in order and liaising with the bank on your behalf.